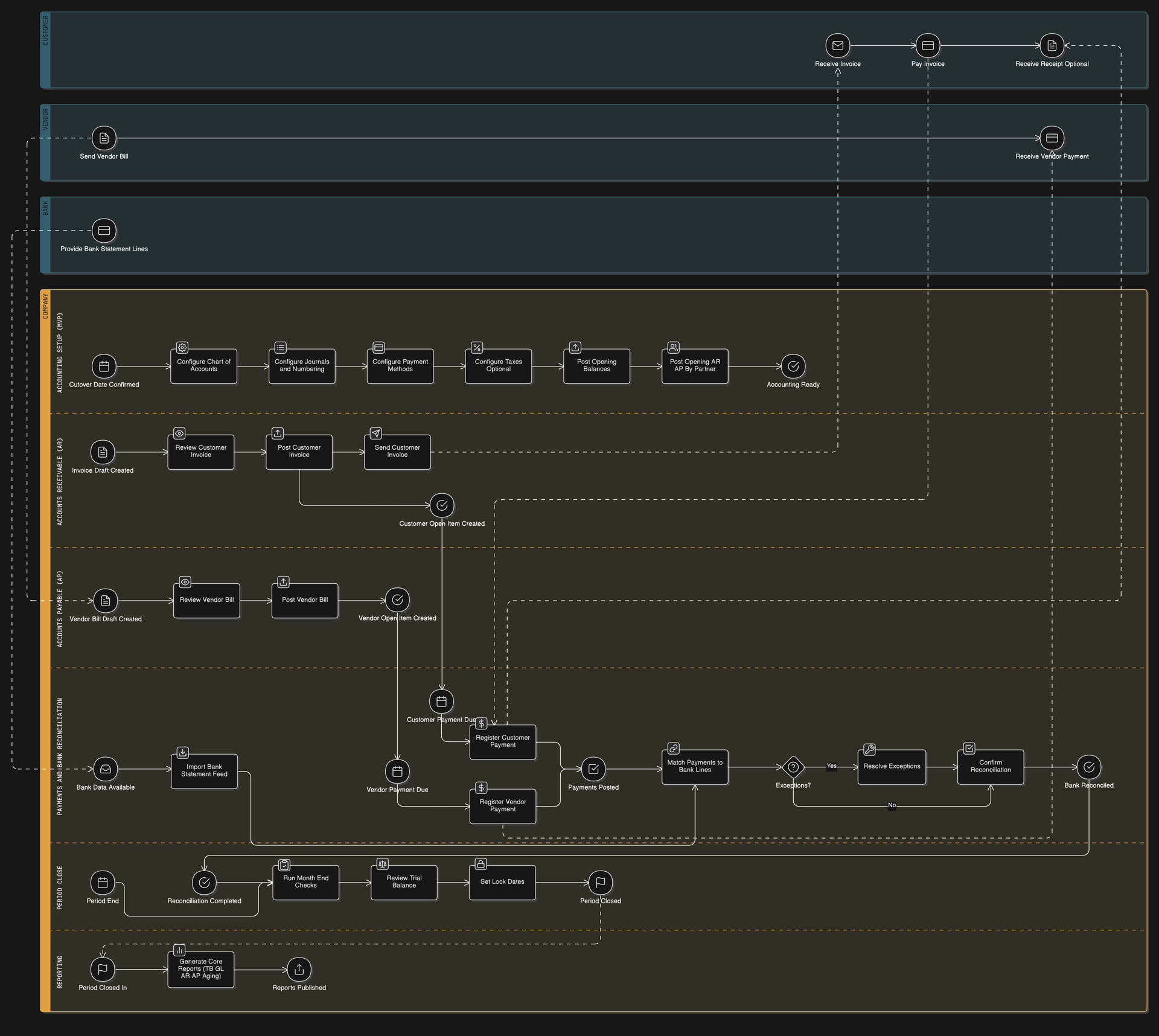

KA-STD-006 — Accounting Standard Flow Implementation (Record-to-Report)

Version: Odoo 19.0

Audience: Accounting Lead, AR/AP, Implementor

Apps: Accounting/Invoicing (+ Sales/Purchase integrations)

Objective: Implement standard finance operations: Invoices/Bills → Payments → Bank Reconciliation → Period Close → Reports

Scope (MVP)

Customer invoices and vendor bills from Sales/Purchase

Payments and bank reconciliation

Core financial reports (TB, GL, AR/AP aging)

Key standard decisions

Journals and numbering

Taxes and fiscal positions (if applicable)

Lock dates, period close process

Integration expectations from Sales/Purchase

Configuration steps

Accounting → Configuration

Chart of accounts, taxes, journals, payment methods

Validate customer invoice and vendor bill processes (from Sales/Purchase) (Odoo)

Data migration checklist

Opening balances (GL)

Opening AR/AP by partner

Open invoices/bills (only if required)

Bank opening balance

End-to-end process

Create/post invoice or bill

Register payment

Reconcile against bank statement lines

Month-end checks and close

UAT scenarios (minimum)

ACC-01 Invoice → payment → bank reconcile (Odoo)

ACC-02 Vendor bill → payment → bank reconcile (Odoo)

ACC-03 Trial balance and AR/AP aging agree to openings

Go-live checklist

Confirm cutover date and lock legacy

Post opening entries and reconcile starting point

Sign-off: trial balance matches legacy at cutover

References

// BPMN for Accounting Standard Flow Implementation (Odoo 19.0)

title Accounting Standard Flow (Record-to-Report) — Input → Process → Output (Odoo 19.0)

// Pools and Lanes

Customer [color: lightblue] {

Receive Invoice [type: event, icon: mail]

Pay Invoice [type: event, icon: credit-card]

Receive Receipt Optional [type: event, icon: file-text]

}

Vendor [color: lightblue] {

Send Vendor Bill [type: event, icon: file-text]

Receive Vendor Payment [type: event, icon: credit-card]

}

Bank [color: lightblue] {

Provide Bank Statement Lines [type: event, icon: credit-card]

}

Company [color: orange] {

Accounting Setup (MVP) [color: lightgray] {

// INPUT

Cutover Date Confirmed [type: event, icon: calendar]

// PROCESS

Configure Chart of Accounts [type: activity, icon: settings]

Configure Journals and Numbering [type: activity, icon: list]

Configure Payment Methods [type: activity, icon: credit-card]

Configure Taxes Optional [type: activity, icon: percent]

Post Opening Balances [type: activity, icon: upload]

Post Opening AR AP By Partner [type: activity, icon: users]

// OUTPUT

Accounting Ready [type: event, icon: check-circle]

}

Accounts Receivable (AR) [color: yellow] {

// INPUT

Invoice Draft Created [type: event, icon: file-text]

// PROCESS

Review Customer Invoice [type: activity, icon: eye]

Post Customer Invoice [type: activity, icon: upload]

Send Customer Invoice [type: activity, icon: send]

// OUTPUT

Customer Open Item Created [type: event, icon: check-circle]

}

Accounts Payable (AP) [color: yellow] {

// INPUT

Vendor Bill Draft Created [type: event, icon: file-text]

// PROCESS

Review Vendor Bill [type: activity, icon: eye]

Post Vendor Bill [type: activity, icon: upload]

// OUTPUT

Vendor Open Item Created [type: event, icon: check-circle]

}

Payments and Bank Reconciliation [color: green] {

// INPUT

Customer Payment Due [type: event, icon: calendar]

Vendor Payment Due [type: event, icon: calendar]

Bank Data Available [type: event, icon: inbox]

// PROCESS

Register Customer Payment [type: activity, icon: dollar-sign]

Register Vendor Payment [type: activity, icon: dollar-sign]

Payments Posted [type: event, icon: check-square]

Import Bank Statement Feed [type: activity, icon: download]

Match Payments to Bank Lines [type: activity, icon: link]

Exceptions? [type: gateway, icon: help-circle]

Resolve Exceptions [type: activity, icon: wrench]

Confirm Reconciliation [type: activity, icon: check-square]

// OUTPUT

Bank Reconciled [type: event, icon: check-circle]

}

Period Close [color: purple] {

// INPUT

Period End [type: event, icon: calendar]

Reconciliation Completed [type: event, icon: check-circle]

// PROCESS

Run Month End Checks [type: activity, icon: checklist]

Review Trial Balance [type: activity, icon: scale]

Set Lock Dates [type: activity, icon: lock]

// OUTPUT

Period Closed [type: event, icon: flag]

}

Reporting [color: lightpurple] {

// INPUT

Period Closed In [type: event, icon: flag]

// PROCESS

Generate Core Reports (TB GL AR AP Aging) [type: activity, icon: bar-chart-2]

// OUTPUT

Reports Published [type: event, icon: share]

}

}

// -------------------------------------------------

// INTERNAL POOL TIMELINES (keeps swimlanes readable)

// -------------------------------------------------

Receive Invoice > Pay Invoice

Pay Invoice > Receive Receipt Optional

Send Vendor Bill > Receive Vendor Payment

Provide Bank Statement Lines

// -------------------------------------------------

// COMPANY SEQUENCE FLOWS (IPO per lane; one arrow per line)

// -------------------------------------------------

// Setup (IPO)

Cutover Date Confirmed > Configure Chart of Accounts

Configure Chart of Accounts > Configure Journals and Numbering

Configure Journals and Numbering > Configure Payment Methods

Configure Payment Methods > Configure Taxes Optional

Configure Taxes Optional > Post Opening Balances

Post Opening Balances > Post Opening AR AP By Partner

Post Opening AR AP By Partner > Accounting Ready

// AR (IPO)

Invoice Draft Created > Review Customer Invoice

Review Customer Invoice > Post Customer Invoice

Post Customer Invoice > Send Customer Invoice

Post Customer Invoice > Customer Open Item Created

// AP (IPO)

Vendor Bill Draft Created > Review Vendor Bill

Review Vendor Bill > Post Vendor Bill

Post Vendor Bill > Vendor Open Item Created

// Payments & Reconciliation (IPO)

Customer Open Item Created > Customer Payment Due

Vendor Open Item Created > Vendor Payment Due

Customer Payment Due > Register Customer Payment

Vendor Payment Due > Register Vendor Payment

Register Customer Payment > Payments Posted

Register Vendor Payment > Payments Posted

Bank Data Available > Import Bank Statement Feed

Import Bank Statement Feed > Match Payments to Bank Lines

Payments Posted > Match Payments to Bank Lines

Match Payments to Bank Lines > Exceptions?

Exceptions? > Confirm Reconciliation: No

Exceptions? > Resolve Exceptions: Yes

Resolve Exceptions > Confirm Reconciliation

Confirm Reconciliation > Bank Reconciled

// Period Close (IPO)

Bank Reconciled > Reconciliation Completed

Period End > Run Month End Checks

Reconciliation Completed > Run Month End Checks

Run Month End Checks > Review Trial Balance

Review Trial Balance > Set Lock Dates

Set Lock Dates > Period Closed

// Reporting (IPO)

Period Closed --> Period Closed In

Period Closed In > Generate Core Reports (TB GL AR AP Aging)

Generate Core Reports (TB GL AR AP Aging) > Reports Published

// -------------------------------------------------

// MESSAGE FLOWS (minimal & short to reduce overlaps)

// -------------------------------------------------

// Customer invoice and payment

Send Customer Invoice --> Receive Invoice

Pay Invoice --> Register Customer Payment

Register Customer Payment --> Receive Receipt Optional

// Vendor bill and payment

Send Vendor Bill --> Vendor Bill Draft Created

Register Vendor Payment --> Receive Vendor Payment

// Bank statements

Provide Bank Statement Lines --> Bank Data Available